Trading Gold and Silver with MT4

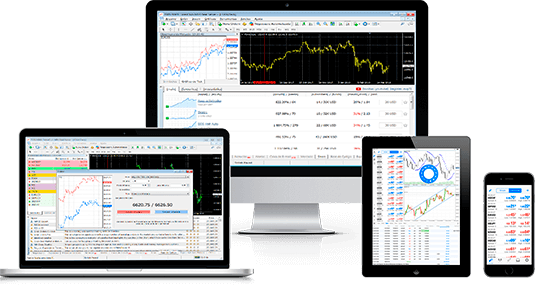

Futures trading is a valuable investment tool that allows traders to speculate on the future price of various assets, including commodities, stock indices, and currencies. MetaTrader 4 (MT4) is a widely used trading platform that enables users to trade futures contracts with ease and efficiency. MT4 offers a wide range of advanced charting tools, technical indicators, and expert advisors (EAs) that can boost your trading performance. In this blog post, you’ll learn how to trade futures with mt4 trading platform and some tips and tricks to maximize your profits.

Understanding the Futures Market

Before you start trading futures with MT4, you need to understand the basics of the futures market. Futures contracts are agreements to buy or sell a particular asset at a specific price and date in the future. You can profit from futures trading by buying low and selling high (going long) or by selling high and buying low (going short). The futures market is highly leveraged, meaning you can control a large amount of assets with a small amount of capital. However, leverage also increases your risk, so you need to manage your risk carefully.

Setting Up MT4 for Futures Trading

To trade futures with MT4, you need to have a futures trading account with a broker that supports MT4. Once you have opened and funded your account, you need to download and install MT4 from your broker’s website. Then, you need to open a futures trading chart in MT4 by selecting the asset, contract, and time frame. You can customize the chart by adding indicators, drawing tools, and other features. You can also create your own custom indicators or EAs using the MQL4 programming language.

Using Technical Analysis for Futures Trading

Technical analysis is a popular method for predicting price movements in the futures market. Technical indicators, such as moving averages, MACD, RSI, and Bollinger Bands, can help you identify trends, momentum, and support and resistance levels. You can also use chart patterns, such as triangles, flags, and head and shoulders, to spot potential breakouts or reversals. However, you should not rely solely on technical analysis and should also consider fundamental factors, such as supply and demand, global news, and economic indicators.

Applying Risk Management Strategies

Risk management is crucial for successful futures trading with MT4. You should always use stop-loss orders to limit your losses and take-profit orders to lock in your profits. You should also use position sizing to control your risk exposure and diversify your portfolio by trading different assets and contracts. In addition, you should avoid overtrading, emotional trading, and chasing losses, as these behaviors can lead to impulsive and irrational decisions.

Learning from Experience and Education

Futures trading with MT4 is a complex and challenging activity that requires continuous learning and improvement. You should keep track of your trades, analyze your performance, and learn from your mistakes. You can also seek advice and guidance from experienced traders, join online forums and communities, or attend training courses and webinars. By investing in your knowledge and skills, you can build a solid foundation for your futures trading career and achieve your financial goals.

Conclusion:

Trading futures with MT4 can be a rewarding and exciting experience if you approach it with discipline, patience, and skill. By understanding the basics of the futures market, setting up MT4 for futures trading, using technical analysis, applying risk management strategies, and learning from experience and education, you can improve your chances of success and become a profitable futures trader. Remember to always trade responsibly and manage your risk carefully to safeguard your capital and maximize your profits. Happy trading!

Proudly powered by WordPress. Theme by Infigo Software.